HMRC Tax Inspection On Foreign Homes

On the 31st October HMRC announced that it has formed a new 200-strong team of investigators and specialists, targeting those with overseas property.

The newly-formed team started work in October, bringing together experts from across the department who will use new techniques to identify areas where individuals are avoiding and evading taxes and duties.

“Data mining” techniques have been applied to publicly available information to identify individuals who own property abroad. HMRC risk assessment tools are then being used to highlight those people who do not appear able legitimately to afford the property, as well as those who do not appear to be declaring the correct income and gains from the property.

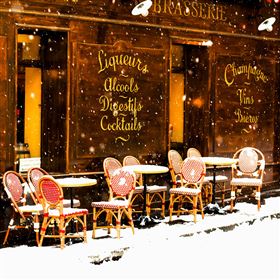

With regards to French property owners who rent out their holiday homes it is important to remember that any letting income generated by the French property owned by a resident in France or the UK, no matter where it is paid or received, is always, first and foremost, taxable in France.

Secondly, if the owner is resident in the UK at the time, the income will also always be taxable in the UK.

As such tax returns are required both in France and the UK.

For further information please contact Alex Romaine on 01844 218956 or email alex@charleshamer.co.uk